"Wobbles the Mind" (wobblesthemind)

"Wobbles the Mind" (wobblesthemind)

05/15/2020 at 13:18 ē Filed to: Quotes

2

2

54

54

"Wobbles the Mind" (wobblesthemind)

"Wobbles the Mind" (wobblesthemind)

05/15/2020 at 13:18 ē Filed to: Quotes |  2 2

|  54 54 |

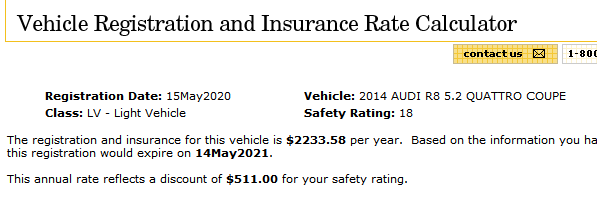

With a $1,000 deductible on Comprehensive Coverage and Collision Coverage, the quote was $438 for 6 months on a 2010 Audi R8 with the 5.2L V10 engine.

A 2014 V10 Audi R8? Exact same price for full coverage.

Dropping the deductibles down to $500 each and the quote skips up to † $489 for 6 months .

Just seems like an oddly affordable car to insure to me. I think that the Alfa Romeo 4C is like that too.

Iím also using Bodily Injury & Property Damage Liability limits of † $250,000 each person/$500,000 each accident/$50,000 each accident.

Honestly, I think exploring the costs to own certain cars is a lot of fun.†

Captain of the Enterprise

> Wobbles the Mind

Captain of the Enterprise

> Wobbles the Mind

05/15/2020 at 13:20 |

|

Why the fuck is my 2011 Camry like $600 more per year to insure than that??

Thisismydisplayname

> Wobbles the Mind

Thisismydisplayname

> Wobbles the Mind

05/15/2020 at 13:22 |

|

It all depends on what state youíre in though. MI has some of the highest insurance premiums due to the medical portion and no fault. †It gets silly expensive for some cars.

davesaddiction @ opposite-lock.com

> Wobbles the Mind

davesaddiction @ opposite-lock.com

> Wobbles the Mind

05/15/2020 at 13:23 |

|

Check an Ď08 M3 sedan manual (my car).

I need to switch to Hagerty (or something), since itís not my daily anymore.†

TheRealBicycleBuck

> Captain of the Enterprise

TheRealBicycleBuck

> Captain of the Enterprise

05/15/2020 at 13:26 |

|

Probably because of the number of people who a) own them and b) crash them.

Actuarial tables are funny things. Although the cost to repair an R8 would be much higher, there are fewer of them, they are better cared for, the risk profile of the typical driver is better (being driving by older, wealthier people), there are fewer of them being wrecked, and as a result, the insurance risk is much lower than with a Camry.

bob and john

> Captain of the Enterprise

bob and john

> Captain of the Enterprise

05/15/2020 at 13:27 |

|

how many camrys get into crashes VS those?

as a percentage. not a raw number.

eg: if 10% of R8s get into crashed, but 20% of camrys do, then the camry will be more expensive to insure.†

Sovande

> davesaddiction @ opposite-lock.com

Sovande

> davesaddiction @ opposite-lock.com

05/15/2020 at 13:31 |

|

Hagerty is nice for agreed value, but I found them too restrictive for garaging. It was also far more expensive. I think I pay about $35 a month for full coverage including comprehensive with Geico . Hagerty was about $110 a month. My car is only worth about $8-9k.

RPM esq.

> Captain of the Enterprise

RPM esq.

> Captain of the Enterprise

05/15/2020 at 13:34 |

|

Maybe you just live in a state where itís more expensive to insure cars. That makes a huge difference...I just looked where I lived and the quote was more close to three times his result.

Wobbles the Mind

> davesaddiction @ opposite-lock.com

Wobbles the Mind

> davesaddiction @ opposite-lock.com

05/15/2020 at 13:35 |

|

With $500 deductibles:

$244 BI & PD + $144 Comp + $293 Collision = $681 for 6 months.

Being in New Mexico probably helps a lot.

Highlander-Datsuns are Forever

> Wobbles the Mind

Highlander-Datsuns are Forever

> Wobbles the Mind

05/15/2020 at 13:37 |

|

Clearly a sign you should get a V10 R8.

Wobbles the Mind

> Thisismydisplayname

Wobbles the Mind

> Thisismydisplayname

05/15/2020 at 13:38 |

|

Big time! Plus, I know the guys up in Canada get killed on car insurance.

RPM esq.

> Wobbles the Mind

RPM esq.

> Wobbles the Mind

05/15/2020 at 13:39 |

|

Where do you live? I just checked and itís more than double that here.

Milky

> Thisismydisplayname

Milky

> Thisismydisplayname

05/15/2020 at 13:40 |

|

I f it aint the truth. $2400 a year for my Miata.

RPM esq.

> bob and john

RPM esq.

> bob and john

05/15/2020 at 13:41 |

|

Itís not quite as simple as that because the value and cost of repair factors into it...I bet less R8s get crashed than C63s as both a percentage and a raw number

but I just looked and an R8 (same year, same mileage, same coverage) would be considerably more expensive to insure than my C63, which is already pretty high.

MKULTRA1982(ConCrustyBrick)

> Wobbles the Mind

MKULTRA1982(ConCrustyBrick)

> Wobbles the Mind

05/15/2020 at 13:50 |

|

Yeah, Iím in one of the most expensive regions in the Country, but I pay about 2200$ (1100 toonies) for a year on a 2011 Fiesta hatch, full coverage 1mil liability 1000$ deductible I think†

Wobbles the Mind

> RPM esq.

Wobbles the Mind

> RPM esq.

05/15/2020 at 13:52 |

|

Iím in Albuquerque, New Mexico. As I get older, Iím appreciating the cost of living out here. Pay isnít as high as other areas though so I guess it all evens out.

Wobbles the Mind

> Highlander-Datsuns are Forever

Wobbles the Mind

> Highlander-Datsuns are Forever

05/15/2020 at 13:53 |

|

Yes! T hat would look so nice next to my Kia Amanti!!

BeaterGT

> Wobbles the Mind

BeaterGT

> Wobbles the Mind

05/15/2020 at 13:54 |

|

Donít remind me :/

Highlander-Datsuns are Forever

> Wobbles the Mind

Highlander-Datsuns are Forever

> Wobbles the Mind

05/15/2020 at 13:59 |

|

Me: next to my 2006 Mazda 3.

Wobbles the Mind

> Captain of the Enterprise

Wobbles the Mind

> Captain of the Enterprise

05/15/2020 at 14:00 |

|

Honestly, thatís one of the cheapest quotes Iíve seen for anything out here. A 2011 Hyundai Accent Sedan is about the same price for the same coverage.

ItalianJobR53 - now with added 'MERICA and unreliability

> Wobbles the Mind

ItalianJobR53 - now with added 'MERICA and unreliability

> Wobbles the Mind

05/15/2020 at 14:15 |

|

That wobbles my mind.

ItalianJobR53 - now with added 'MERICA and unreliability

> BeaterGT

ItalianJobR53 - now with added 'MERICA and unreliability

> BeaterGT

05/15/2020 at 14:16 |

|

Buy it! You need something as fast as the Vette

diplodicus forgot his password

> RPM esq.

diplodicus forgot his password

> RPM esq.

05/15/2020 at 14:41 |

|

Ya, I'm pretty sure he lives in Michigan as well. We have the highest rates in the country I think. I pay more for liability only on my e30 than wobbles was quote for the r8

fintail

> RPM esq.

fintail

> RPM esq.

05/15/2020 at 14:44 |

|

I pay $130/month for full coverage on the E wagon, and compared to some people I know, and the relative expense and complexity of the car, that isnít so bad around here.

RPM esq.

> fintail

RPM esq.

> fintail

05/15/2020 at 14:54 |

|

Yeah thatís not bad

. Thatís about what I

pay (

each)

for the

4Runner and C63, although I suspect it breaks down more

like 120/150 at best.

RPM esq.

> Wobbles the Mind

RPM esq.

> Wobbles the Mind

05/15/2020 at 14:56 |

|

Maybe... I used to think those differences evened out

but the vast difference in housing costs between places sometimes more than makes up the difference in wages.

BeaterGT

> ItalianJobR53 - now with added 'MERICA and unreliability

BeaterGT

> ItalianJobR53 - now with added 'MERICA and unreliability

05/15/2020 at 14:58 |

|

Ok, ok. Iíll throw a bigger turbo on the Subaru.

ranwhenparked

> Wobbles the Mind

ranwhenparked

> Wobbles the Mind

05/15/2020 at 15:11 |

|

Thatís right about exactly what Iím paying to insure a damn Camaro.

Iíve long speculated that Iím being screwed, except I never seem to find anything appreciably lower when I shop around. Really thought thereíd be more of a noticeable drop in rates in my mid 30s vs my 20s, but not so far.†

ItalianJobR53 - now with added 'MERICA and unreliability

> BeaterGT

ItalianJobR53 - now with added 'MERICA and unreliability

> BeaterGT

05/15/2020 at 15:15 |

|

Why not both?!?

V10 R8 AND big turbo subie

punkgoose17

> Wobbles the Mind

punkgoose17

> Wobbles the Mind

05/15/2020 at 15:16 |

|

Saw an Amanti thought of you, end of work too tired to walk over for proper pictures.

DasWauto

> MKULTRA1982(ConCrustyBrick)

DasWauto

> MKULTRA1982(ConCrustyBrick)

05/15/2020 at 15:33 |

|

Oof. I pay a bit under that for my Ď17 WRX in Ontario, with double the coverage, iirc. Amusingly, my 128i costs half that. Are you under 25?

Wobbles the Mind

> punkgoose17

Wobbles the Mind

> punkgoose17

05/15/2020 at 16:09 |

|

You spoil me!

bob and john

> RPM esq.

bob and john

> RPM esq.

05/15/2020 at 16:20 |

|

100%. But keep in mind the payout. The car is a small portion of the payout, medical bills are far higher.

And those stay the same if you are in a camry or a r8.

fintail

> RPM esq.

fintail

> RPM esq.

05/15/2020 at 16:30 |

|

This area isnít as bad as say MI or FL/GA, but is still far from cheap, I suspect due to the derpiness on the road here.

Fortunately, the fintail averages to something around $10/month with Hagerty, so that evens it out a little.

davesaddiction @ opposite-lock.com

> Wobbles the Mind

davesaddiction @ opposite-lock.com

> Wobbles the Mind

05/15/2020 at 16:57 |

|

Iím pretty sure I can pay that for a year by changing insurers (a less than 5k miles† per year policy).

davesaddiction @ opposite-lock.com

> Sovande

davesaddiction @ opposite-lock.com

> Sovande

05/15/2020 at 16:57 |

|

I thought they were pretty comparable when I checked, but maybe I need to get new quotes. My car is probably worth $15-20k.†

Sovande

> davesaddiction @ opposite-lock.com

Sovande

> davesaddiction @ opposite-lock.com

05/15/2020 at 17:01 |

|

I would think it makes more sense as the value of the car increases. If I owned something I was going to keep forever I would certainly think about it. Or if 5th Gen El Caminos become †sought after or desirable.†

davesaddiction @ opposite-lock.com

> Sovande

davesaddiction @ opposite-lock.com

> Sovande

05/15/2020 at 18:09 |

|

I donít think my car will depreciate too much more, especially if the miles donít keep getting racked up. Itís at 126k, and Iíll drive it 5k per year. I assume theyíll level out close to where E39 M5s have.†

Spasoje

> Wobbles the Mind

Spasoje

> Wobbles the Mind

05/15/2020 at 19:30 |

|

ďIím also using Bodily Injury & Property Damage Liability limits of $250,000 each person/$500,000 each accident/$50,000 each accident.Ē

I was wondering why it was so damn cheap, until I got to this part. Around here, people buy $2-3m liability. I donít think you can even choose under $1m, unless you donít buy optional coverage at all.

Spasoje

> TheRealBicycleBuck

Spasoje

> TheRealBicycleBuck

05/15/2020 at 19:40 |

|

Funny story. My friend (with about the same years experience as me) was complaining how the cost to insure his Ď03 Corolla w/ his GF was $2.7k a year.

A couple days later, I was talking to my insurance agent about how much it would cost me to insure a Ď20 M4 - that quote was $3k per year.

I asked my agent about my friendís situation, specifically asking if the high price heís paying was because of the number of people who own and crash Corollas versus something like an M4.

The agentís response: ďthat has absolutely nothing to do with it. Thereís something your friendís not telling you.Ē

Looks like common cars being expensive to insure is just a myth.

Captain of the Enterprise

> TheRealBicycleBuck

Captain of the Enterprise

> TheRealBicycleBuck

05/15/2020 at 20:41 |

|

Thatís a good point.†

Captain of the Enterprise

> RPM esq.

Captain of the Enterprise

> RPM esq.

05/15/2020 at 20:42 |

|

Wayne county Michigan which I think is highest in the country.†

Captain of the Enterprise

> Wobbles the Mind

Captain of the Enterprise

> Wobbles the Mind

05/15/2020 at 20:43 |

|

Yeah I pay like 1700 a year for mine.†

MKULTRA1982(ConCrustyBrick)

> DasWauto

MKULTRA1982(ConCrustyBrick)

> DasWauto

05/15/2020 at 22:48 |

|

Just turned 25 this year a nd I need to shop around for insurance

Longtime Lurker

> Wobbles the Mind

Longtime Lurker

> Wobbles the Mind

05/16/2020 at 00:19 |

|

Neat. I got a slightly different price for Saskatchewan

TheRealBicycleBuck

> Spasoje

TheRealBicycleBuck

> Spasoje

05/16/2020 at 01:39 |

|

Funny story. I was an agent for a year, so I learned a bit about how it all works. What I shared was part of the training to become an agent. Rates are a function of risk. Part of it is the person, part of it is the property being insured, and part of it is the insurance agreement - deductibles, total coverage, etc.

TheRealBicycleBuck

> RPM esq.

TheRealBicycleBuck

> RPM esq.

05/16/2020 at 01:44 |

|

There are many factors that go into a specific quote, but when you compare total risk for a given vehicle versus other vehicles for all drivers , then itís not surprising that the average rate for a more expensive vehicle can be less than the average rate for a more common vehicle. Iíd bet the total risk for any given insurance company tied up in Camrys is an order of magnitude higher than is tied up in R8s.

RPM esq.

> TheRealBicycleBuck

RPM esq.

> TheRealBicycleBuck

05/16/2020 at 02:25 |

|

Sure.

Go quote an R8 on your personal

insurance vs. a Camry. I did, itís three times more expensive.

RPM esq.

> Captain of the Enterprise

RPM esq.

> Captain of the Enterprise

05/16/2020 at 02:26 |

|

That would do it as opposed to the OP in New Mexico.

RPM esq.

> fintail

RPM esq.

> fintail

05/16/2020 at 02:27 |

|

Yeah, my wagon is cheap on Hagerty. Low miles, of course, but it accurately reflects the manner

and infrequency with which I drive it.

DasWauto

> MKULTRA1982(ConCrustyBrick)

DasWauto

> MKULTRA1982(ConCrustyBrick)

05/16/2020 at 09:16 |

|

Thatíll do it. I think mine dropped around 30% when I turned 25. Luckily my renewal was less than a month after my birthday so it took effect quickly.†

TheRealBicycleBuck

> RPM esq.

TheRealBicycleBuck

> RPM esq.

05/16/2020 at 11:03 |

|

I think you missed the point. I said average rate. For any given person with the exact same usage (daily driver, same mileage, etc.), then you expect the cost to be higher. But when you look at the average cost and all the the things that are different between insuring a Camry and an R8, then the cost can be and often is lower to insure the less expensive vehicle. What makes the difference? Lots of things. Miles driven per year, age and driving record, number of vehicles on the policy, credit rating, where they live, etc.

B y the way, comparing a Camry to an R8 on my policy with the exact same deductibles and miles driven , an R8 would be about 1,000 more to insure. However, if I keep the same deductibles and treat it as a second car driven fewer miles and for ďpleasureĒ instead of commuting, the cost to insure is only $200 more than the cost to insure the Camry. This is how most of the supercars are insured.

Once my truck got old enough that it was practically worthless, the insurance cost started going up on our comprehensive policy. It wasnít that it was a more expensive vehicle. It wasnít because of a higher cost of repair. It was probably because the risk profile was shifting to a lower economic class and that was driving up losses.†

Spasoje

> TheRealBicycleBuck

Spasoje

> TheRealBicycleBuck

05/16/2020 at 13:19 |

|

This is exactly it. For every agent you talk to that says the common car thing is a myth, youíll find another who says itís true. How do I, as a consumer, know which one of you to believe?

TheRealBicycleBuck

> Spasoje

TheRealBicycleBuck

> Spasoje

05/16/2020 at 13:37 |

|

Good question. Although Iím not aware of an insurance company that releases its actuarial tables, you can get some sense in some states where the state insurance commission sets the rates. Texas, where I was licensed, sets the median † rate and gives companies leeway to be 20% higher or lower. I can tell you that when a company feels it cannot cover its costs at median + 20%, they put a moratorium on writing additional policies. This happened twice when I was an agent. Both were moratorium on new policies. Once due to excessive losses due to flooding, the other due to losses from a major hail storm. Only the first one affected me since I lived and worked in the area which flooded. They basically made it impossible for a new agent to make a living since my salary was directly tied to sales. I decided to stick with my day job (many agents, especially new ones, have two careers).

So, to get back to your question, in Texas, the state sets the rate. Insurance companies have their own actuarial tables that tell them where they want to be on rates given the state rate, their costs, their losses, and the risk level for both the car and the† driver. If a certain model becomes popular with thieves, you can bet that the rate is going to go up. If itís a common car with a high loss rate, the cost to insure is going up. If itís a common car with a low loss rate, the cost to insure should go down.†

RPM esq.

> TheRealBicycleBuck

RPM esq.

> TheRealBicycleBuck

05/16/2020 at 14:10 |

|

Yes, I definitely missed the point insofar as ďitís not surprising that the average rate for a more expensive vehicle can be less than the average rate for a more common vehicleĒ apparently meant ď the more expensive vehicle can be cheaper to insure if you change every single assumption in the equation to make it that way.Ē